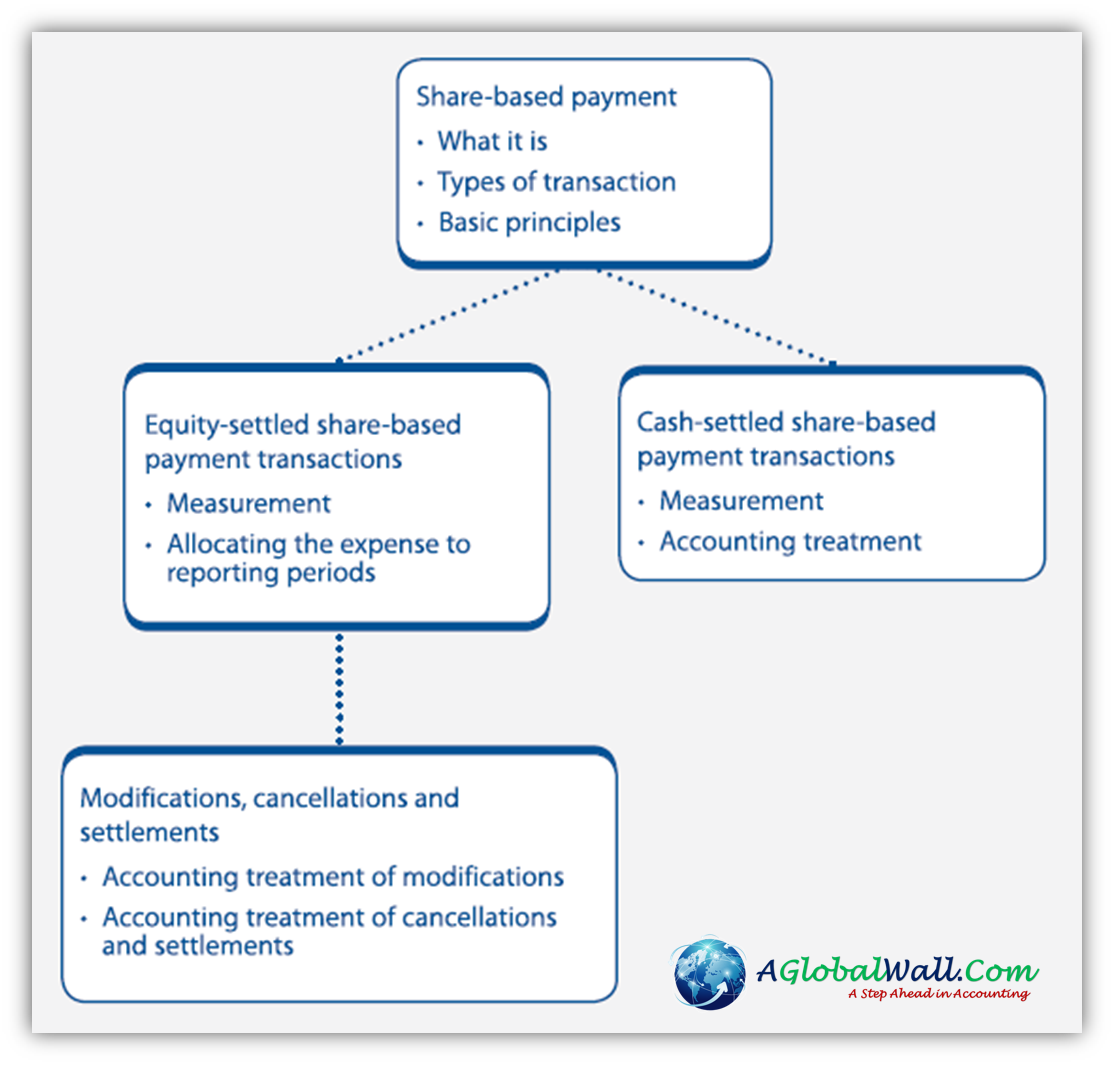

IFRS 2 Share Based Payments

Share on Social Networks

IFRS 2 Share Based Payments Introduction

IFRS 2 Share Based Payments has become increasingly common. Share-based payment occurs when an entity buys goods or services from other parties (such as employees or suppliers) and:

- settles the amounts payable by issuing shares or share options, or

- incurs liabilities for cash payments based on its share price.

The problem If a company pays for goods or services in cash, an expense is recognised in profit or loss. If a company ‘pays’ for goods or services in share options, there is no cash outflow and therefore, under traditional accounting, no expense would be recognised. If a company issues shares to employees, a transaction has occurred. The employees have provided a valuable service to the entity, in exchange for the shares/options. It is inconsistent not to recognise this transaction in the financial statements. IFRS 2 Share-based Payment was issued to deal with this accounting anomaly. IFRS 2 requires that all share-based payment transactions must be recognised in the financial statements when the transaction takes place.

Arguments against recognizing share-based payments

No cost, therefore, no charge

Entities receive good and services without paying anything, so they use to say that there is no cost so they will not recognize any expense in their statements. There is no outflow of economic benefit from the entity. Employees are providing their valuable services to the company over the time period and against them, they will receive shares.

Earnings per share would be hit twice

By recognizing share based payments as a expense in the statement of profit and loss, it will decrease the profit and recognizing the shares in the equity will increase the no. of shares so in this way the EPS will be hit twice.

The formula to calculate EPS = Profit / No. of share

Adverse economic consequences

Companies will stop to give the shares to their employees as bonuses. So it will not be favorable for the employees. If companies stop to give share options to their employees will affect adverse on the employee benefits.

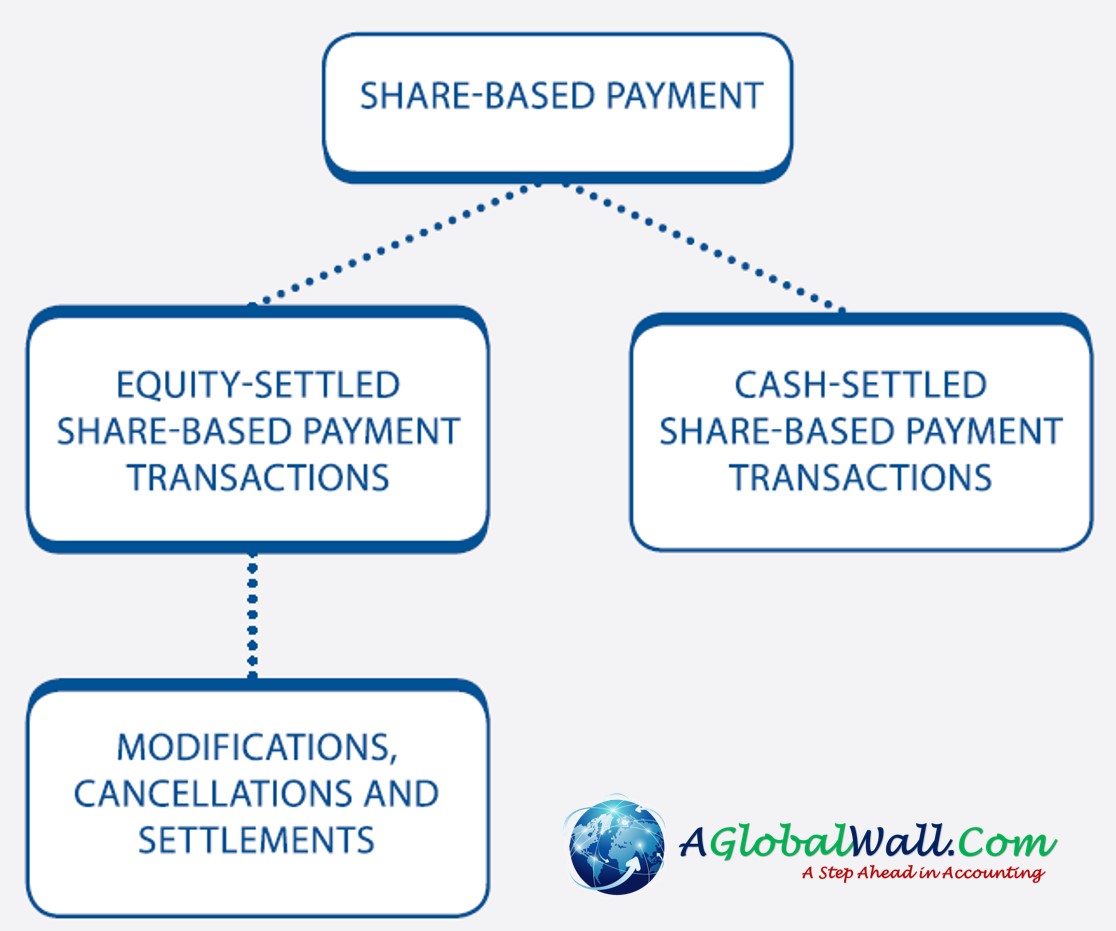

Types of transaction

1. Equity-settled share-based payments

2. Cash-settled share-based payments

Equity-settled share-based payment transactions

Dr. Expense/asset

Cr Equity

The entry to equity is normally reported in ‘other components of equity’. Share capital is not affected until the share-based payment has ‘vested’

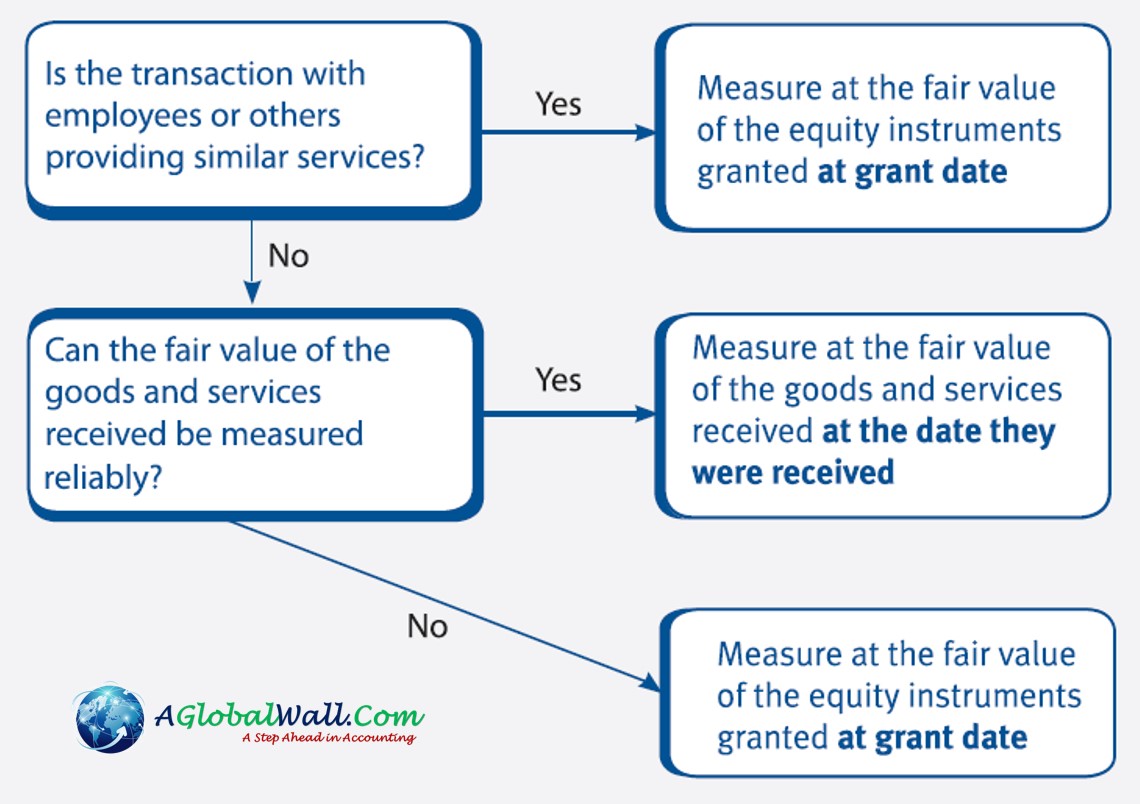

Measurement The basic principle is that all transactions are measured at fair value.

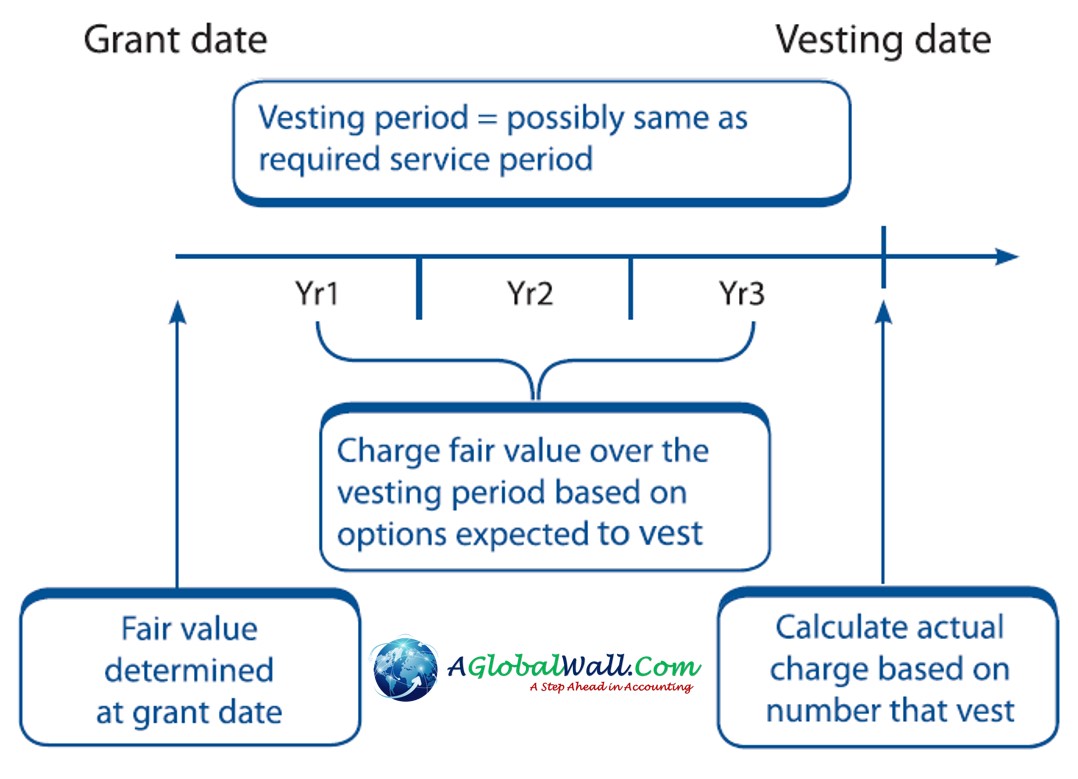

The grant date is the date at which the entity and another party agree to the arrangement.

The vesting date is the date on which the counterparty (e.g. the employee) becomes entitled to receive the cash or equity instruments under the arrangement.

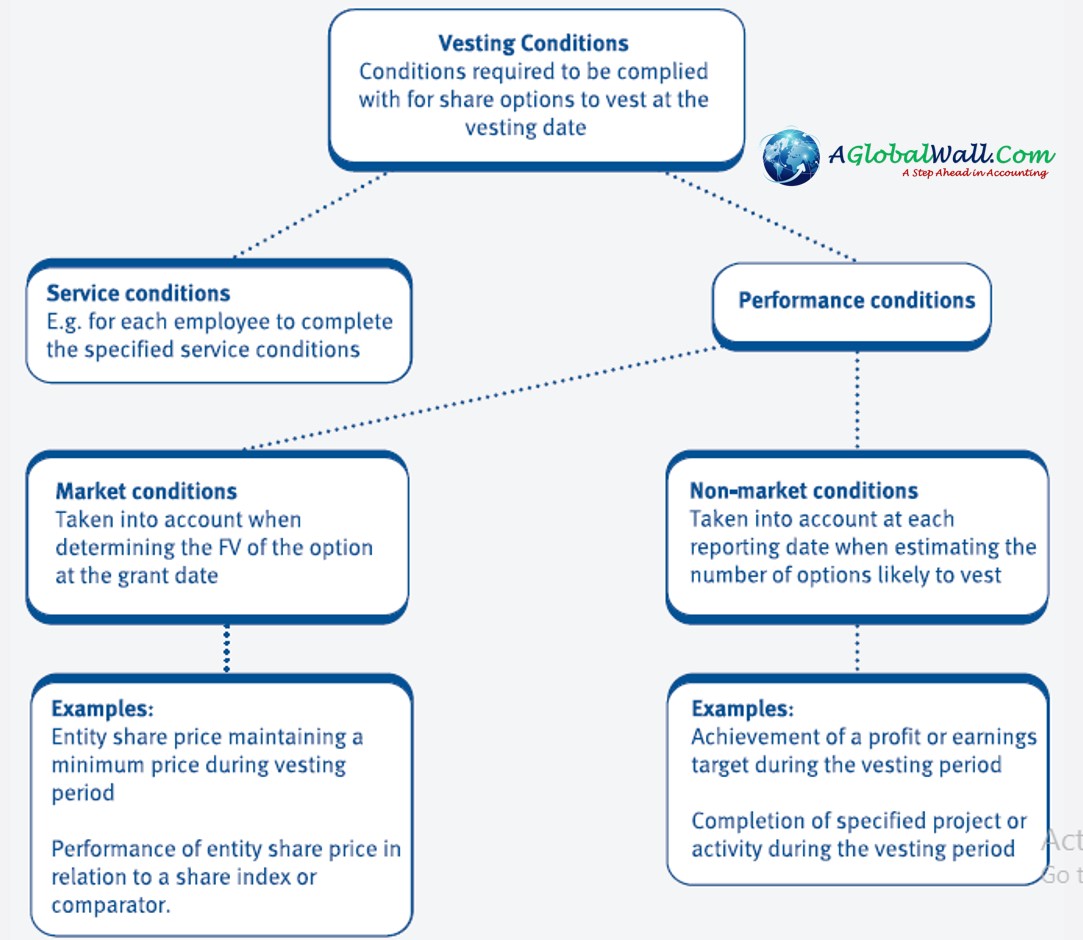

Performance conditions

- achieving a specified increase in the entity’s profit

- the completion of a research project

- achieving a specified increase in the entity’s share price.

- A market condition is defined by IFRS 2 as one that is related to the market price of the entity’s equity instruments. An example of a market condition is that the entity must attain a minimum share price by the vesting date for scheme members to be eligible to participate in the share-based payment scheme.

- Non-market performance conditions are not related to the market price of the entity’s equity instruments. Examples of non-market performance conditions include EPS or profit targets.

The impact of performance conditions

- Market based conditions have already been factored into the fair value of the equity instrument at the grant date. Therefore, an expense is recognised irrespective of whether market conditions are satisfied.

- Non-market based conditions must be taken into account in determining whether an expense should be recognised in a reporting period.

Accounting after the vesting date IFRS 2 states that no further adjustments to total equity should be made after the vesting date. This applies even if some of the equity instruments do not vest (for example, because a market based condition was not met). Entities may, however, transfer any balance from ‘other components of equity’ to retained earnings.

Modifications to the terms on which equity instruments are granted An entity may alter the terms and conditions of share option schemes during the vesting period. For example:

- it might increase or reduce the exercise price of the options (the price that the holder of the options has to pay for shares when the options are exercised). This makes the scheme less favourable or more favourable to employees.

- it might change the vesting conditions, to make it more likely or less likely that the options will vest.

Cancellations and settlements An entity may cancel or settle a share option scheme before the vesting date.

- If the cancellation or settlement occurs during the vesting period, the entity immediately recognises the amount that would otherwise have been recognised for services received over the vesting period (‘an acceleration of vesting’

- Any payment made to employees up to the fair value of the equity instruments granted at cancellation or settlement date is accounted for as a deduction from equity.

- Any payment made to employees in excess of the fair value of the equity instruments granted at the cancellation or settlement date is accounted for as an expense in profit or loss.

2. Cash-settled share-based payment transactions Examples of cash-settled share-based payment transactions include:

- share appreciation rights (SARs), where employees become entitled to a future cash payment based on the increase in the entity’s share price from a specified level over a specified period of time

- the right to shares that are redeemable, thus entitling the holder to a future payment of cash.

Accounting treatment The double entry for a cash-settled share-based payment transaction is:

Dr Profit or loss/Asset

Cr Liabilities

Measurement The entity remeasures the fair value of the liability arising under a cash-settled scheme at each reporting date. This is different from accounting for equity-settled share-based payments, where the fair value is fixed at the grant date.

Allocating the expense to reporting periods Where services are received in exchange for cash-settled share-based payments, the expense is recognised over the period that the services are rendered (the vesting period). This is the same principle as for equity-settled transactions.

The value of share appreciation rights (SARs) SARs may be exercisable over a period of time. The fair value of each SAR comprises the intrinsic value (the cash amount payable based upon the share price at that date) together with its time value (based upon the fact that the share price will vary over time). When SARs are exercised, they are accounted for at their intrinsic value at the exercise date. The fair value of a SAR could exceed its intrinsic value at this date. This is because SAR holders who do not exercise their rights at that time have the ability to benefit from future share price rises. At the end of the exercise period, the intrinsic value of a SAR will equal its fair value. The liability will be cleared and any remaining balance taken to profit or loss.

Hybrid transactions

- The scheme should be accounted for as a cash-settled share-based payment transaction if the entity has an obligation to settle in cash.

- If no obligation exists to settle in cash, then the entity accounts for the transaction as an equity-settled share-based payment scheme.

Group share-based payment transactions

A subsidiary might receive goods or services from employees or suppliers but the parent (or another entity in the group) might issue equity or cash settled share-based payments as consideration. In accordance with IFRS 2, the entity that receives goods or services in a share-based payment arrangement must account for those goods or services irrespective of which entity in the group settles the transaction, or whether the transaction is settled in shares or cash.

Disclosures

- a description of share-based payment arrangements

- the number of share options granted or exercised during the year, and outstanding at the end of the year.

- the total share-based payment expense

- the total carrying amount of liabilities arising from share-based payment transactions.

You May also Like

ACCA F5 PM Past Papers and Answers

ACCA P2 Video Lecture 1 for 2017-18 Attempts

Latest ACCA P2 LSBF Videos Lectures

What are the five fundamental principles of the ACCA’s ethical code?

Latest ACCA P2 Becker Study Material 2017