IAS 19 Employee Benefits Summary

IAS 19 Employee Benefits Summary

Dear Students, we have an article for you on IAS 19 Employee Benefits Summary form. You can revise your standard by reading this complete standard. We hope you like it and we will share more standards in the summarized form so you can understand them easily. So let’s start;

Watch Video Lecture on IAS 19 – Employee Benefits on the below link

ACCA P2 Video Lecture 1 for 2017-18 Attempts

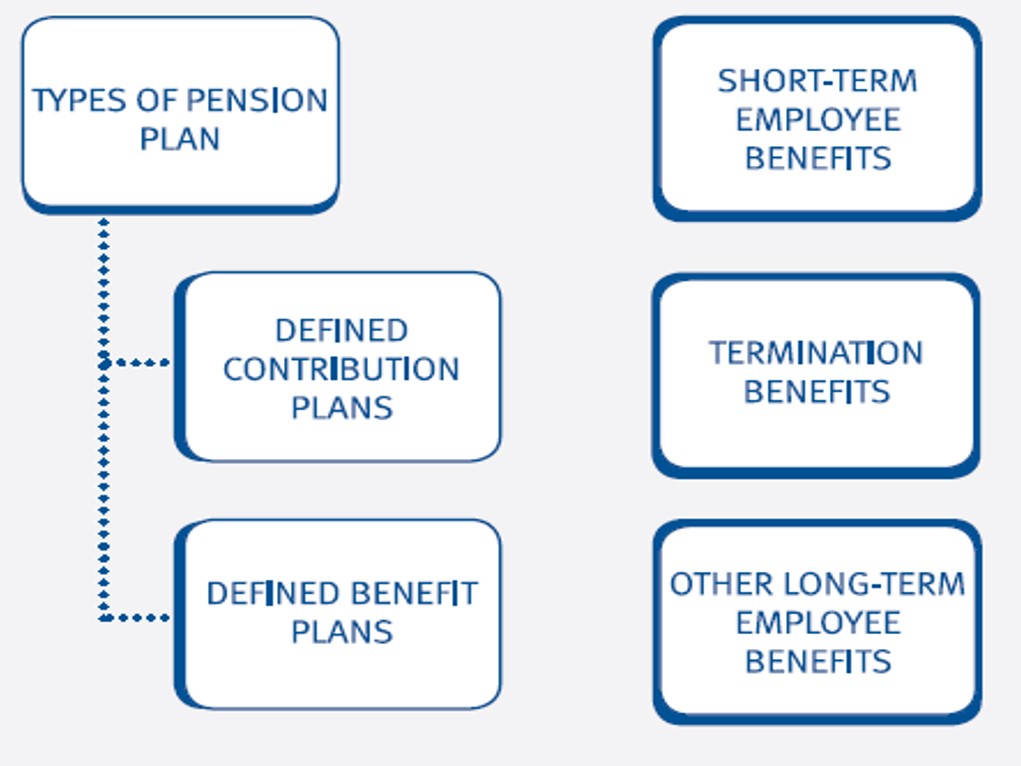

Types of employee benefit

1. Post-employment benefits

These benefits will be given to the employees on their retirement or at the end of their employment. For example, the pension is the main type of this benefit.

2. Short-term employee benefits

Employees get these benefits during their job for example wages and salaries on monthly basis.

3. Termination benefits

These benefits will be given at the termination of the employment contract is ended with the consent of the employer and the employee

4. Other long-term employee benefits

Those benefits which are not covered in the above three types are dealt in this type. Companies pay long sick leave and disability payments to their employees.

Post-employment benefit plans

Defined contribution plans

Defined contribution plans are benefit plans where the entity ‘pays fixed contributions into a separate entity and will have no legal or constructive obligation to pay further contributions if the fund does not hold sufficient assets to pay all employee benefits relating to their service’

Defined benefit plans

Defined benefit plans are post-employment plans that are not defined contribution plans.

Accounting for defined contribution plans

The entity should charge the agreed pension contribution to profit or loss as an employment expense in each period. The expense of providing pensions in the period is often the same as a number of contributions paid. However, an accrual or prepayment arises if the cash paid does not equal the value of contributions due for the period.

Test Your Understanding

An entity makes contributions to the pension fund of employees at a rate of 5% of gross salaries. For convenience, the entity pays $10,000 per month into the pension scheme with any balance being paid in the first month of the following accounting year. The wages and salaries for 20X6 are $2.7 million.

Required: Calculate the pension expense for 20X6, and the accrual/ prepayment at the end of the year.

The charge to profit or loss should be:

$2.7m × 5% = $135,000 The statement of financial position will therefore show an accrual of $15,000, being the difference between the $135,000 expense and the $120,000 ($10,000 × 12 months) cash paid in the year.

Accounting for defined benefit plans

Under a defined benefit plan, an entity has an obligation to its employees. The entity, therefore, has a long-term liability that must be measured at present value. The entity will also be making regular contributions to the pension plan. These contributions will be invested and the investments will generate returns. This means that the entity has assets held within the pension plan, which IAS 19 states must be measured at fair value.

On the statement of financial position, an entity offsets its pension obligation and its plan assets and reports the net position: It is difficult to calculate the size of the defined benefit pension obligation and plan assets. It is therefore recommended that entities use an expert known as an actuary.

- If the obligation exceeds the assets, there is a plan deficit (the usual situation) and a liability is reported in the statement of financial position.

- If the assets exceed the obligation, there is a surplus and an asset is reported in the statement of financial position.

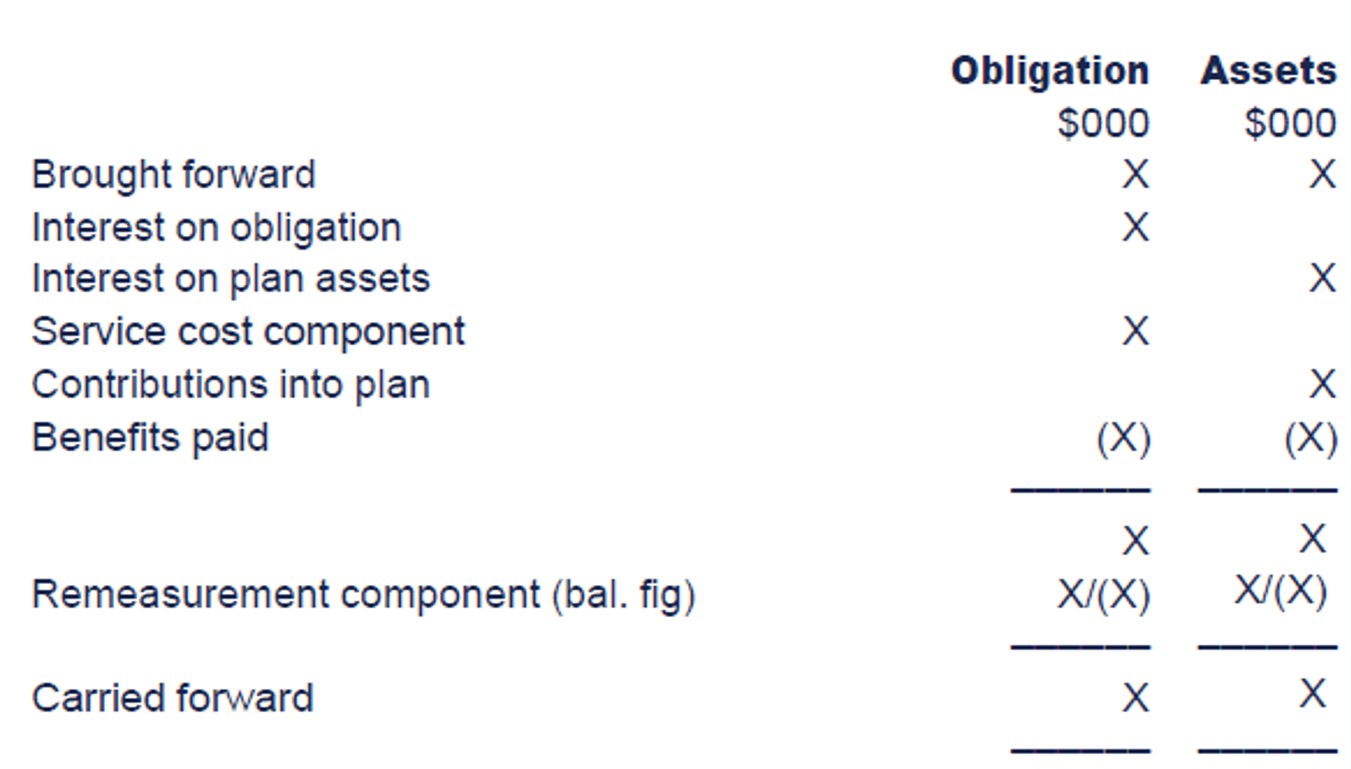

The year-on-year movement

The following proforma shows the movement on the defined benefit deficit (surplus) over a reporting period

The net interest component

This is charged (or credited) to profit or loss and represents the change in the net pension liability (or asset) due to the passage in time. It is computed by applying the discount rate at the start of the year to the net defined benefit liability (or asset).

The service cost component

This is charged with profit or loss and is comprised of three elements:

- Current service cost, which is the increase in the present value of the obligation arising from employee service in the current period. period.

- Past service cost, which is the change in the present value of the obligation for employee service in prior periods, resulting from a plan amendment or curtailment

- Any gain or loss on settlement

Contributions to the plan

These are the cash payments paid into the plan during the reporting period by the employer. This has no impact on the statement of profit or loss and other comprehensive income.

Benefits paid

These are the amounts paid out of the plan assets to retired employees during the period. These payments reduce both the plan obligation and the plan assets. Therefore, this has no overall impact on the net pension deficit (or asset).

Remeasurement Component

After accounting for the above, the net pension deficit will differ from the amount calculated by the actuary as at the current year-end. This is for a number of reasons, that include the following:

- The actuary’s calculation of the value of the plan obligation and assets is based on assumptions, such as life expectancy and final salaries, and these will have changed year-on-year.

- The actual return on plan assets is different from the amount taken to profit or loss as part of the net interest component.

An adjustment, known as the Remeasurement component, must, therefore, be posted. This is charged or credited to other comprehensive income for the year and identified as an item that will not be reclassified to profit or loss in future periods.

A curtailment is a significant reduction in the number of employees covered by a pension plan. This may be a consequence of an individual event such as plant closure or discontinuance of an operation, which will typically result in employees being made redundant.

A settlement occurs when an entity enters into a transaction to eliminate the obligation for part or all of the benefits under a plan. For example, an employee may leave the entity for a new job elsewhere, and a payment is made from that pension plan to the pension plan operated by the new employer.

- The gain or loss on settlement comprises the difference between the fair value of the plan assets paid out and the reduction in the present value of the defined benefit obligation and is included as part of the service cost component.

- The gain or loss on a settlement is recognized on the date when the entity eliminates the obligation for all or part of the benefits provided under the defined benefit plan.

The Asset ceiling

Most defined benefit pension plans are in deficit (i.e. the obligation exceeds the plan assets). However, some defined benefit pension plans do show a surplus.

If a defined benefit plan is in surplus, IAS 19 states that the surplus must be measured at the lower of:

- the amount calculated as normal (per earlier examples and illustrations)

- the total of the present value of any economic benefits available in the form of refunds from the plan or reductions in future contributions to the plan.

This is known as applying the ‘asset ceiling’. It means that a surplus can only be recognized to the extent that it will be recoverable in the form of refunds or reduced contributions in the future. In other words, it ensures that the surplus recognized in the financial statements meets the definition of an ‘asset’ (a resource controlled by the entity that will lead to a probable inflow of economic benefits).

Criticisms of IAS 19

Retirement benefit accounting continues to be a controversial area. Commentators have perceived the following problems with the IAS 19 approach:

- The fair values of plan assets may be volatile or difficult to measure reliably. This could lead to significant fluctuations in the statement of financial position.

- IAS 19 requires plan assets to be valued at fair value. Fair values of plan assets are not relevant to the economic reality of most pension schemes. Under the requirements of IAS 19, assets are valued at short-term amounts, but most pension scheme assets and liabilities are held for the long term. The actuarial basis of valuing plan assets would better reflect the long-term costs of funding a pension scheme. However, such a move would be a departure from IFRS 13 Fair Value Measurement which seeks to standardize the application of fair value measurement when it is required by a particular reporting standard.

- The treatment of pension costs in the statement of profit or loss and other comprehensive income is complex and may not be easily understood by users of the financial statements. It has been argued that all the components of the pension cost are so interrelated that it does not make sense to present them separately.

Thanks for reading this standard, if you have any question in mind. You can ask in the comments section. We will try to answer it ASAP.

easy to understand and follow. Thanks i understood from the first reading I would have appreciated a practical example on the year on year movement